Digital India – from skepticism to awe

The steady digitisation of the Indian economy has been fascinating to watch. It not only overturned the age-old skepticism with regards to execution (attached to anything where the government is involved), but also decimated the prejudice most ‘learned men’ had with regards to digital adoption by a large section of Indians who still remain poor and uneducated.

Since 2014, the Indian Government has put in place several building blocks that are expected to set a strong foundation for inclusive growth in the years to come.

Aadhaar, DBT and UPI

Aadhaar has been instrumental in achieving the objective of financial inclusion across the country and revolutionising the way India transacts at a micro level. The Aadhaar enabled payment system built the foundation for a full range of Aadhaar enabled banking services in the country. The linking of over 44 crore (440 million) Jan Dhan Yojana Accounts and the Direct Benefits Transfer (DBT) programme that has enabled over 300 welfare schemes, both cash and subsidy, fixed monetary leakages worth thousands of crores of rupees. These benefits are now being extrapolated into healthcare, with Ayushman Bharat and the COWIN portal.

However, the true potential of digitising India’s economy was unleashed in 2016 when demonetisation witnessed widespread adoption of UPI. This was a life saver during the recent COVID Pandemic and gave us a glimpse of the potential of India’s digital economy. From groceries to jewellers, from peanut sellers to supermarkets, UPI was seamlessly adopted by Indians both as buyers and sellers.

Here’s a link to an interesting visualisation by India in Pixels of the total UPI transaction values from Oct 2016 to Mar 2022 https://twitter.com/indiainpixels/status/1513836619039535104?s=20&t=_MCK3GV99sv8f3r16ZW5tA

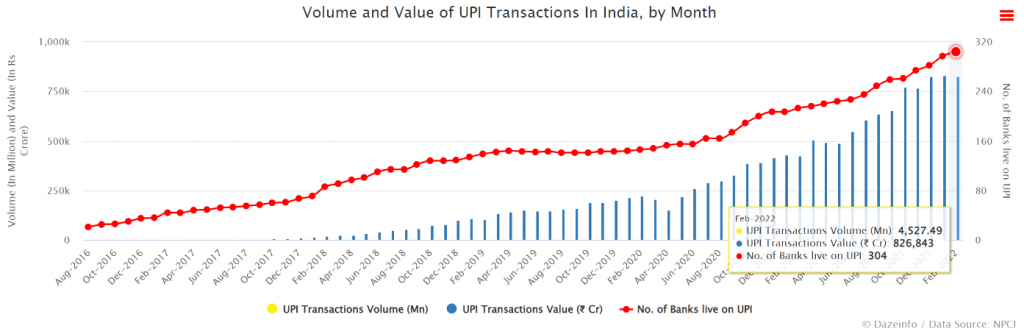

While going from a mere 21 banks, and 0.09 million transactions and Rs 3.1crore in transaction value in August 2016, to 304 banks, and more than 4.5 billion transactions, and more than Rs 8.2 lakh crore transaction value in Feb 2022, UPI, as a payment interface is still merely a 10% of where it could be in the next five years – projected at 50 billion transactions per month.

Account Aggregators

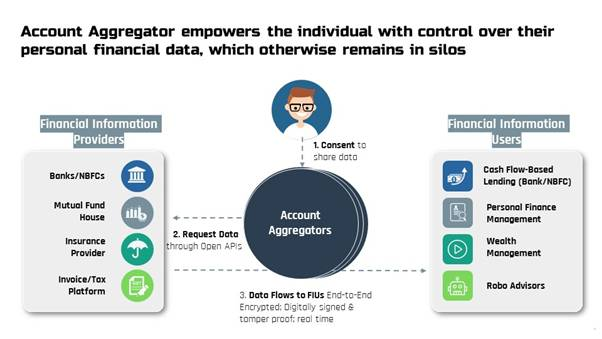

As the UPI train speeds ahead, in Sep 2021, RBI came out with the Account Aggregator Framework. Account Aggregators are RBI licensed and structured as NBFCs. Their main role will be to bridge the credit gap between financial lenders and borrowers with limited credit history and who are currently denied credit through formal sources for the same reason. It is estimated that for every single rupee accessed as credit through formal sources in India, six more rupees are accessed through informal sources, and this demand for credit runs into almost Rs 70 lakh crore. The aggregators draw information pertaining to a single borrower or company, only after the informed consent of that borrower, and share it with the financial service providers, which may include banks, creditors, wealth managers, personal wealth managers, and other financial consultants a borrower may wish to work with. Account aggregation involves the collection, assembly and synthesis of information from multiple accounts, such as loan/credit accounts, savings and current accounts, credit cards and investment accounts (including mutual funds, demat accounts, brokerage accounts); government accounts such as public provident fund and income tax returns data; and supplementary business or consumer accounts such as those of e-commerce, food or mobility aggregators in a single place. The data collection, collation and sharing are enabled through open application programming interface (API) connections. Moving beyond the traditional, assets-based approach of credit rating agencies, account aggregation incorporates cash flow-based inputs such as income from various sources, expenses, invoices, receipts and tax returns.

ONDC

We now come to the next building block in India’s digital economy ie. democratising e-commerce. India has countless aspiring entrepreneurs from both rural and urban segments who wish to get their businesses online. What option does a women entrepreneur based in Alappuzha, making coir curios have today to sell her wares online? The choice boils down to Amazon or Flipkart. The challenges for most such sellers include a hefty commission and delivery cost that these platforms charge. This is true for every platform e-commerce model currently operating in India, whether in retail or in food. Misuse of customer data is another issue with these platforms which they often use to undercut sellers on their platform to push their own products.

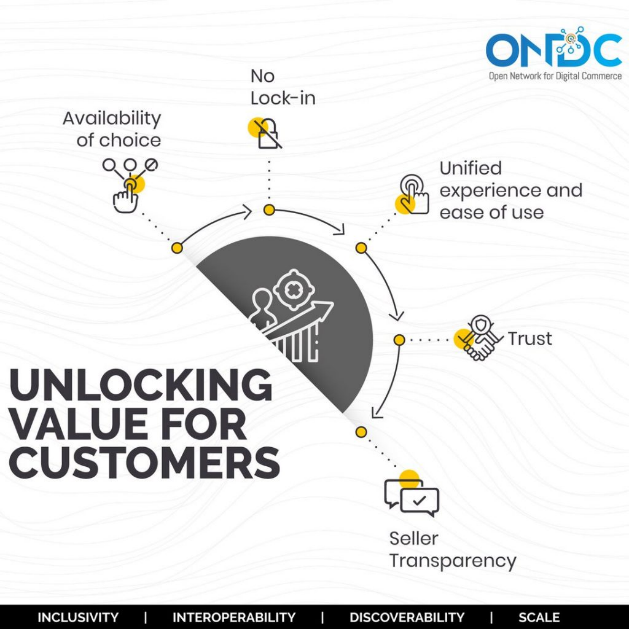

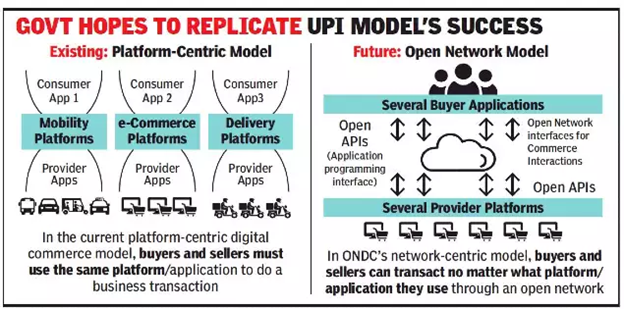

This is where ONDC comes into play. Currently, a seller must list their products on all the different platforms if he wants access to different markets. Thus, a product listed on Amazon is not available on Reliance’s JioMart, or a seller listing himself on Swiggy does not automatically get listed on Zomato. For each platform, both the sellers and buyers need to access a different app, and have a unique access credential. The ONDC solves this problem by moving from a platform-centric model to a transaction-centric model. Just like with UPI, a set of open protocols will govern the interoperability between the apps on the buyers and sellers side. Thus, as long as the buyer and seller, both, are visible, it would not matter which app they use to conduct the transaction. Think of ONDC is to e-commerce what UPI is to payments. The scan code used to make UPI payments today can be accessed through any app, be it BHIM, Google Pay etc. and the payment can be made from any linked bank account. The government’s role here will not be of creating an app for the buyer or seller, but by creating the open protocol or gateway around which several such apps can be built by third-parties, as was the case with UPI as well.

How does ONDC benefit the sellers:

How does it impact the the buyers:

Buyers get more options to choose from, better pricing, and access to local retailers who would otherwise be absent from the likes of Amazon or Flipkart.

Given the success of the other building blocks, one cannot be but optimistic about the ONDC, and hope that it ushers a new era within India’s e-commerce sector, turbo charge our quest for financial inclusion and bolster India’s digital economy.

Head - Deal Advisory, Saints & Masters