Top news of the week

The RBI Annual Report for FY 2021-22

The Indian central bank came out with its annual report for the year 2021-22 last week. The report covers a wide array of topics including inflation, liquidity, growth, and the overall health of the banking sector in India. Since we have extensively covered inflation in our earlier newsletters, we will steer clear of this and focus on a couple of interesting aspects that caught our eye in the Annual Report.

- NBFCs- red flags & warning bells

The RBI has observed in its report that balance sheets of NBFCs have expanded even as their asset quality deteriorated. The regulator has said that some of these entities pose potential threat to financial stability as their size increases due to higher risk appetite.

We have, in our Week In Perspective for the second week ended 14th May, expressed concerns that the NBFC sector may face multiple headwinds in the form of regulatory pressures, asset quality issues and increasing compliance requirements. Read the newsletter here https://saintsandmasters.com/week-in-perspective-may-09-may-15/.

NBFCs make a real contribution towards supporting real economic activity and acting as a supplemental channel of credit intermediation alongside banks. However, the RBI noted that over the past few years, higher risk appetite of NBFCs have contributed over time to their size, complexity and interconnectedness, thereby making some of these entities systemically significant that pose a potential threat to financial stability of the nation. Nearly a dozen NBFCs have expanded their balance sheets exponentially, mainly in the retail segment, prompting the RBI to bring down the regulatory arbitrage of such companies with banks — and make them almost on par with banks in terms of regulatory oversight.

Although the RBI has been tightening regulations for the NBFC sector ever since Infrastructure Leasing & Financial Services (IL&FS) went bust in 2018, creating a liquidity crisis, the pace and focus of these measures have gained significant momentum recently. In the past few years, the country also saw the failure of many large NBFCs such as DHFL, Srei Group entities, and Reliance Capital.

The central bank has been narrowing the regulatory arbitrage that existed between banks and NBFCs and also introduced scale-based regulatory framework for the sector, wherein larger NBFCs will be subject to tighter regulations, given their systemic importance.

In the current financial year, the regulator is planning to put in several measures for both banks and NBFCs to strengthen the regulatory and supervisory framework. A revised regulatory framework for these entities which provides for a layered structure based upon their size, activity, and perceived riskiness, and will be applicable from October 1, 2022. The RBI has also issued guidelines extending the prompt corrective action framework for NBFCs. The RBI has also strengthened on-site supervision and compliance as it believes the failure of an NBFC will pose a threat to the banking system. The total exposure of banks to NBFCs was Rs 10.54 lakh crore as on March 25, according to RBI data.

Evidencing stricter oversight, the RBI, on Wednesday, cancelled the certificate of registration of 5 NBFCs – UMB Securities Ltd, Anashri Finvest, Chadha Finance, Alexcy Tracon, and Jhuria Financial Services for violation of norms related to outsourcing and fair practices code in their digital lending operations. These companies were apparently also not complying with the extant regulations pertaining to charging of excessive interest and had resorted to harassment of customers for loan recovery.

The narrowing of regulatory arbitrage and tighter regulations has resulted in the mortgage financier HDFC Ltd deciding to merge with HDFC Bank. With tighter compliance requirements and very little wriggle room, we expect action to pick up on the M&A and securitisation side within the sector with large NBFCs either selling part of their book to banks to remain below the regulatory threshold for larger oversight or merging with larger banks.

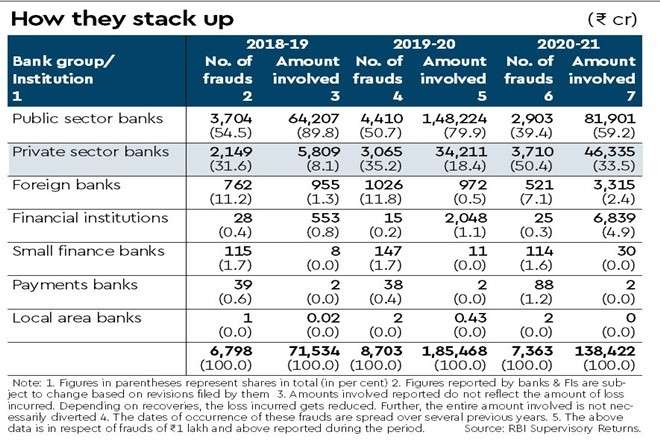

- Bank frauds- 50% decline in value, but 24% increase in number

Source: RBI, Indian Express

The RBI annual report said that frauds reported by banks and other financial institutions, in value terms, more than halved in FY 2021-22 despite the number of instances of fraud increasing.

An analysis of bank group-wise fraud cases over the last three years indicates that while private sector banks reported the maximum number of frauds (circa 50%) , public sector banks contributed maximum in terms of the fraud amount (circa 59%). Also, frauds reported by private sector banks were mainly on account of small value card/internet frauds and the fraud amount reported by public sector banks was mainly in their loan portfolio.

The report also highlights considerable time delay in fraud detection with over 93% of the frauds detected in 2021-22 by value actually occurring in the previous fiscal years as against over 91% detected in 2020-21. The report states that the average time lag between the date of occurrence of frauds and the date of detection was 23 months for the frauds reported in 2020-21. However, in respect of large frauds of Rs 100 crore and above, the average lag was 57 months for the same period. This is not necessarily a hard benchmark given that the process of identifying, monitoring and digging for proof takes many months and in some cases, several years before lenders formally report an account as fraud to the regulator.

The rise of tech in banking has also increased instances of frauds, making the system and consumers vulnerable. In FY22, nearly 40% of the total number of frauds were associated with cards and online transactions, up from 30% share two years ago. Loans, of course, continue to form the lion’s share in both numbers and value of frauds.

If an account is declared as fraud, banks need to set aside 100% of the outstanding loans as provisions, either in one go or spread over four quarters, as per RBI norms. A rise in the number of cases reported may not necessarily indicate a rise in frauds but merely more vigilance in reporting dubious transactions by lenders.

RBI’s assessment of the banking sector

Commenting on the banking sector, the report observed the sector was cushioned against pandemic-related disruptions through adequate liquidity support and regulatory dispensations provided by the RBI. Banks bolstered their capital to augment their risk-absorbing capacity, aided by recapitalisation in public sector banks along with capital-raising from the market and retention of profits by both PSBs and private banks. GNPA ratio of all scheduled commercial banks moderated to its lowest level in six years, aided by due efforts towards recoveries and technical write-offs. Bank credit growth has also begun to pick up to track nominal GDP growth and banks are regaining bottom lines – the report said.

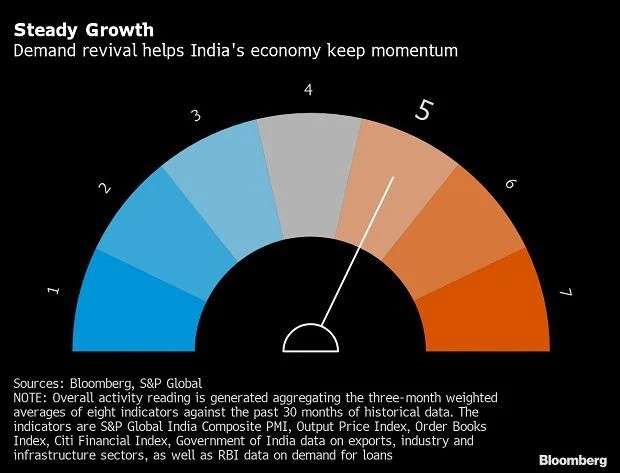

Strong demand powers Indian economy past record inflation, for now

India’s government and its central bank acted in tandem this month to counter price pressures, with steps such as tax cuts and a surprise increase in borrowing costs. The economy maintained its momentum in April as a wider reopening from the pandemic kept rising prices from depressing demand for the time being. Activity in the services sector as well as factories gained last month, while the three-month weighted averages of monthly changes in indicators from exports to credit demand suggested enduring strength.

Other Highlights of the Week

Govt releases revised Draft National Data Governance Framework Policy (NDGFP)

The government has invited inputs on the Draft National Data Governance Framework Policy (NDGFP) that aims to enhance access, quality, and use of data, in line with the current and emerging technology needs of the decade.

The NDGFP standards and rules will ensure data security and informational privacy. This Policy shall be applicable to all government departments and entities and rules and standards prescribed will cover all data collected and being managed by any government entity,” the Ministry of Electronics and Information Technology (MeitY) said in the latest draft policy. It also said this policy would be applicable to all non-personal datasets and data and platform, rules, standards governing its access and use by researchers and start-ups; and State governments would also be encouraged to adopt the provisions of the Policy and rules, standards, and protocols as applicable. An ‘India Data Management Office (IDMO)’ shall be set up under the Digital India Corporation (DIC) under MeitY and shall be responsible for framing, managing and periodically reviewing and revising the Policy.

The IDMO will also prescribe rules and standards including anonymization standards for all entities (government and private) that deal with data that will cause every government ministry / department / organisation to identify and classify available datasets and build a vibrant, diverse and large base of datasets for research and innovation.

For data anonymization, the IDMO will set and publish data anonymization standards and rules to ensure informational privacy is maintained.

Sources