Top news of the week

Bank Credit growth more than doubled in April 2022

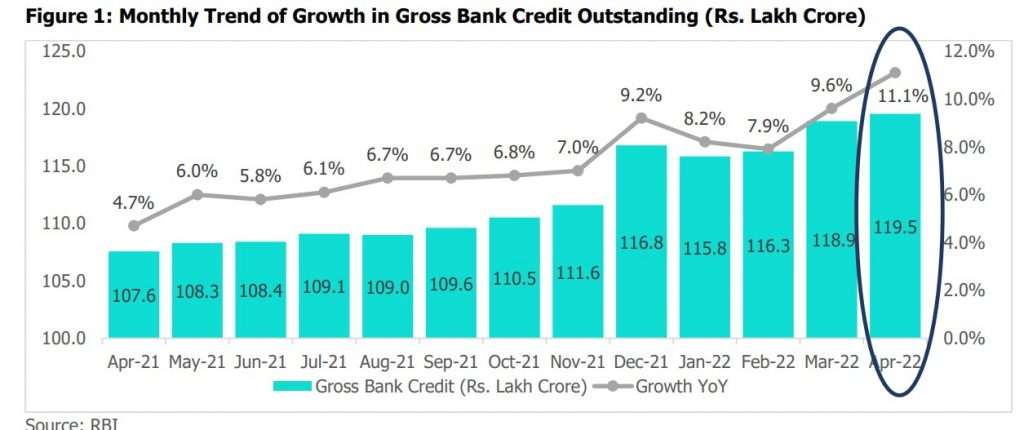

Last week RBI announced the sectoral deployment of bank credit for the month of April 2022. Gross bank credit rose 11.1% y-o-y in April 2022 from a 4.7% y-o-y growth for the same period in the previous year, while non-food credit grew by 11.3% y-o-y in April 2022 as against a growth of 4.7% in April 2021. Key drivers for the credit growth came from the following sectors:

- Retail

- Services

- Industry

The outlook for bank credit growth is expected to remain positive due to economic expansion, rise in government and private capital expenditure, rising commodity prices and retail credit push.

Source: RBI

Retail loan segment credit growth

The retail loan credit outstanding has reached Rs.34.4 lakh crore in April 2022 from Rs.33.8 lakh crore in March 2022 driven by growth in personal and housing loans.

Personal loans clocked a double-digit growth at 14.7% in y-o-y in April 2022 due to:

- overall increase in economic activities

- job market and

- increase in small ticket size loans

Housing loans grew at a pace of 13.7% in April 2022 as compared to a growth of 9.9 %.

With normalisation visible in the economy, retail credit growth is likely to pick up due to an uptick in economic activities and focus on retail/personal loans.

Service sector credit growth

Bank credit growth to the service sector has seen an increase of 11.1%in April 2022 as compared to 2.4% for the same period of last year. This growth was contributed mainly by:

- NBFCs : On account of overall improvement in economic activities and banks renewed focus on lending to NBFCs. Bank credit to NBFCs grew by 10.4% to INR 10.5 lakh crore in April FY22. NBFCs witnessed a growth of 1.2% in April 2022 from a drop of 4.1% for the same period over a year ago.

- Trade

- Tourism

- Hotels and restaurants

- Transport operators.

Aviation was the only segment within the service sector which declined by 18.3% during this period.

Industrial sector credit growth

Bank credit to industry grew at its fastest pace in eight years in April 2022. Loans to the industrial sector including large, medium, small and micro industry grew 8.1% year on year to Rs 31.52 lakh crore. The main reason for the increase were:

- Higher working capital requirements on account of elevated inflation

- Improving production levels

- Higher exports

- Select shifting of the capital market activities to the banking system due to liquidity pressures and higher risk premiums within the equity capital markets

Credit to medium enterprises grew at the fastest pace of 53.5% year on year and loan to micro and small enterprises grew by 29% during this period, driven by the Emergency Credit Line Guarantee Scheme. Growth in credit exposure to large enterprises stood at 1.6%.

IRDAI takes steps to improve ease of doing insurance business

The Insurance Regulatory and Development Authority of India permitted insurers to launch health and most of the general insurance products without prior approval. According to IRDAI, the insurance industry is expected to use this opportunity for the introduction of customised and innovative products, and expansion of the choices available to the policyholders to address the dynamic needs of the market, which will further help in enhancing the insurance penetration in India.

“While the move provides for speedy introduction of innovative products, insurers will now have a greater responsibility to ensure robust product development and pricing along with policyholder protection,” said Shanai Ghosh, Executive Director and CEO, Edelweiss General Insurance.”

Other Highlights of the Week

Demand decline for FMCG products in May month

Reduced consumption of daily essentials due to rising prices across products caused India’s FMCG market’s value growth to a month on month fall of 16.5% in May. Sales shrunk across categories led by commodities like edible oil, home care and confectionery. Experts said consumers are stocking smaller packs of commodities, hoping for a price drop in the future.

New SEBI framework for cybersecurity and cyber resilience for KRAs

SEBI has changed the cybersecurity and the cyber resilience framework and mandated KRAs (KYC registration agencies) to conduct a comprehensive cyber audit at least twice in a financial year. This move is expected to make KRAs responsible to carry out independent validation of the KYC records uploaded onto their system by the Registered Intermediaries (RIs). Key aspects for this new framework which will come into force with immediate effect are as follows:

- KRAs are required to identify and classify critical assets based on their sensitivity and criticality to business operations, services and data management.

- KRAs must conduct a comprehensive cyber audit at least twice in a financial year

- KRAs must conduct regular Vulnerability Assessments and Penetration Tests (VAPT) at least once in a financial year.

Sources